I’d like to think I’ve got a talent for understanding how hype and momentum are built.

I learned this skill set by doing. I picked it up simply by being a cool kid working in the trenches of the business of style.

How does hype turn into capital? Well it’s complicated. Consider two significant trends from my youth. Was Indie Sleeze a real cultural moment or manufactured? Did we get taken in by the HypeBeast? Ask Glenn Youngkin in his Caryle Group era about his Supreme investment. Get Gavin McInnes and James Jebbia to go a couple rounds about their relative wealth. and come back to me. Still unsure? Ask Barbara Kruger about the clusterfuck of uncool jokers.

The original culture and the commodification of the culture is a spectrum and the Tommy Hilfiger Event Horizon is infinite. Who makes culture, who money and who only brings money can be challenging to calculate.

The thing about cool, it’s sine qua non, is that it grapples at every stage of its existence with its own validity. Cool thrives as a grounding process to what’s actually happening in reality.

Cool is a relational experience between someone or something authentically popular amongst a group that relates well with each other.

And that relational power is validated by some wider need in the world for their belief, innovation, art, product or philosophy. Sometimes this can be quite irrational surely but consensus is hard to come by. One of the classic essays in validation of cool is geeks, mops and sociopaths in subculture evolution.

The validation of something “cool” eventually reaches a point of opportunistic acceptance by those merely into a thing for the capital. Sometimes it’s social and sometimes literal currency.

These so called “sociopaths” who follow the momentum often do not realize that they are just in it to capitalize on cool. I don’t want to suggest anyone in a thing for money or cachet is a sociopath just that incentives for status are significant drivers for people.

Often we need the people in it for the money. It’s wonderful that angel investing exists and momentum investors have perfectly rational incentives. Sometimes you will even see significant self awareness about this. If you put resources into a community and don’t cause trouble you are often welcome.

Now you can refer to this type in startup investing as dumb money. The follow-on capital that is riding on the work of others who authentically believed before a thing was cool is a necessary part of the ecosystem.

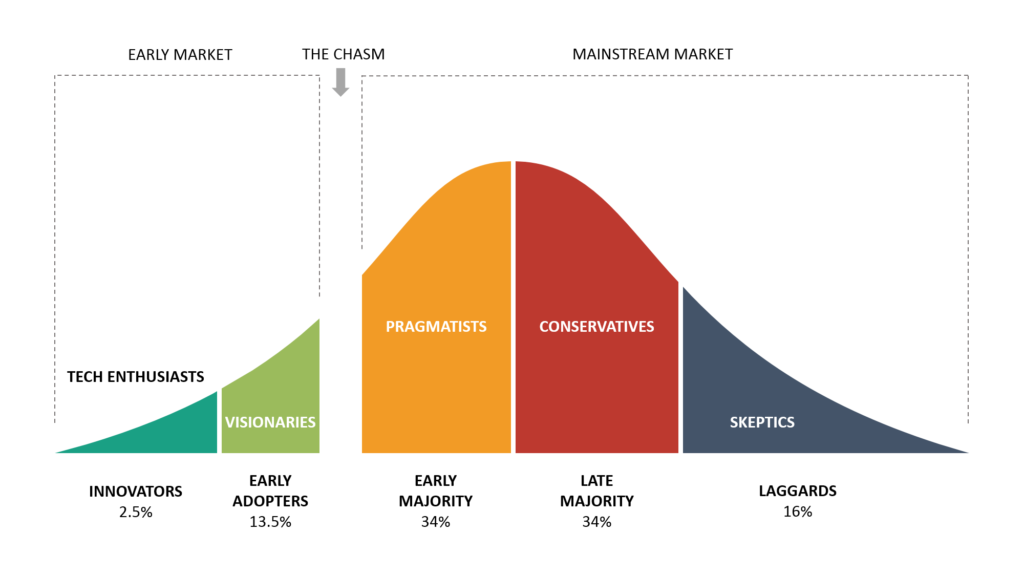

I don’t at all mind when someone is a follower. You can be “a cringe follower late adopter” or whatever terminology we are now using to describe laggards in the adoption curve.

Everett Rogers in his book Diffusion of Innovations

Unless you are a pain in the ass, actively predatory, or making your contribution more trouble than it’s worth, you should go ahead and lend your support if you can take the risk.

Don’t take it personally when hipsters sneer. They may have been earlier than you but it’s fine to back winners. Just don’t expect the founders to give you special dispensation for getting on board when it was safe to do so. It’s right that the alpha premium applies. I personally love it when not only am I right but I got paid more for the privilege.