It’s been a busy week for the MilFred family as it has been busy for many families across the word. We are praying for you.

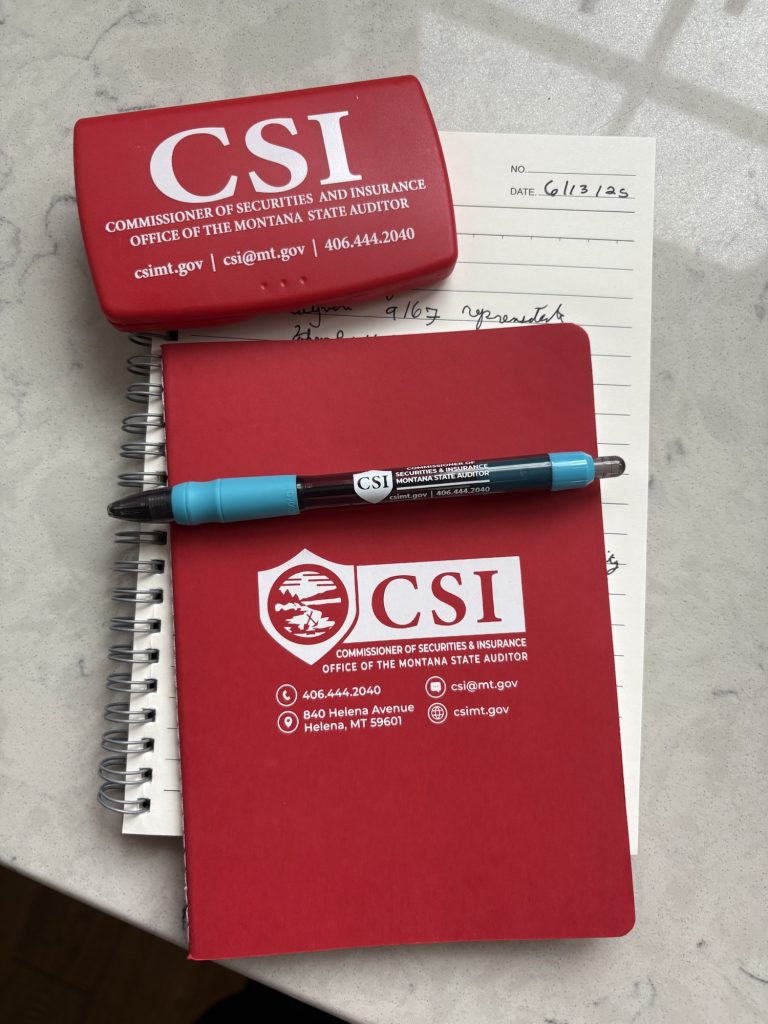

This morning Alex and I were excited to attend the “Digital Assets Public Hearing” in Bozeman put on by The Commissioner of Securities and Insurance Office of the Montana State Auditor.

That is big job and a large office and an important one even if it may sound a bit dry to the average person. They oversee everything from securities fraud and data breach reporting to Medicare and health insurance markets.

I overstrained myself the last couple of days (Alex’s birthday was worth it) so my Whoop was blinking red but but I wasn’t going to miss an important public meeting on a topic crucial to Montana’s future.

For me, the future hinges on to compute and energy. Montana is well positioned. We secured our right to compute this year thanks to State Senator Zolnikov’s bill. And the work continues to as our civil servants.

On June 13, 2025, at 10:00 A.M., CSI will hold a second public hearing in the Cottonwood Room of the Bozeman Public Library at 626 E. Main St., Bozeman, Montana 59715, to further consider the public’s comments regarding digital assets and possible regulation of such digital assets.

It drew quite a crowd both in person and over the internet as Montana has quickly gained a reputation of being future and freedom focused. And quite reasonably so.

The Commissioner is the statewide elected official responsible for administering the Securities Act of Montana. As part of his duties, the Commissioner is responsible for the regulation of securities in Montana, including encouraging capital formation while also safeguarding Montana investors through mechanisms such as registration and disclosure, as well as antifraud enforcement powers…

The market for digital assets has rapidly expanded in recent years, and the unsettled regulatory landscape at the Federal level has left several questions open. Some bad actors have also exploited the market expansion and the public’s interest in digital assets in fraudulent ways. The public’s perceptions, experiences, and knowledge of digital assets may aid the Commissioner in determining whether rules or definitions regarding digital assets may be helpful for the people of Montana.

The goal is to help the commissioner and his team understand this emerging market and make sure it works to the benefit of Montanas especially as the lack of federal regulatory clarity has been a challenge we are personally familiar with.

We hope we can help Montana can help her citizens flourish with the right tools. In the past we mined “pro y plata” with picks and shovels but in the future we may use Montana energy to mine Bitcoin and other cryptocurrencies and tokens. So make your voice heard!