I’m fairly well branded as a doomer, so I hate to break ranks with my preparedness brethren, but I’m absolutely sick of the powerful using fear as a tool to control people.

It isn’t a new problem. This is the go-to tactic our species has used insofar as we can verify with written history.

Any time we experience a change of circumstance, material reality or technology, we hear the braying of the old guard and the panic of the precarious.

People complain for two basic reasons. If you are doing well why change a system that benefits you? If you aren’t successful but equally aren’t comfortable with change, then you resent anyone who benefit from change. Fear and resentment are the shadows of the human soul. Envy is the sin of our time.

I personally feel I’ve invested a lot in doing my part to educate people on risks from climate to currency and compute.

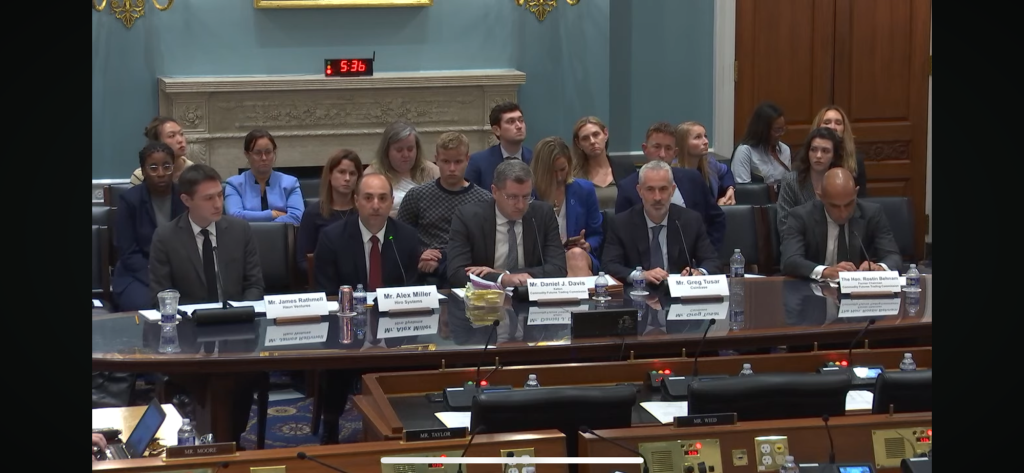

I am politically involved in crypto policy as well as fighting fear in artificial intelligence. I helped pass the only piece of AI legislation in the world focused on liberty. I want people to have a choice for how they engage in a virtual future.

I’m not just a nerd about being prepared either. I’ve done my wilderness first responder certification. We left Colorado for Montana for a host of reasons but top of them was a better and freer climate both literally and figuratively. We live this way because it’s a great way to live and when change happens we are hoping to be resilient.

Having all that in mind I was offline for the 4th of July long weekend as it has been a busy year on all of those fronts. So I was sleeping it off. To come back and see a spate of conspiracies over cloud seeding technology was like a punch to the gut. And I’m already feeling like I’m on the outs with some community when it comes to technology and my intentions.

I’ve only met Augustus Doricko of Rainmaker a handful of times but his circle of young technical Christians dedicated to building solutions to our modern problems are why I remain optimistic in fighting for technology and the people who build it.

These kinds of communities of builders exist in an archipelago of anarchic communities across digital and physical worlds that interlay across many systemic problems. These places will succeed no matter the future we face because they understand it’s necessary to build. That is will.

I’ve been lucky to have been the first investor in Isaiah Taylor’s Valar Atomics. He is a part of this builder world and of a part of a clan of physical builders. He faces decades of fear with a cheerful heart. I believe in his vision for energy abundance.

Nuclear energy was buckled under an old environmentalisms that was a proxy for a fear of a future whose risks, however minimal, were too scary to embrace for those in charge and the public they controlled.

I believe in a vision of a better America (and a better ecosystem and a better economy) because we embrace change to build materially better conditions.

I have frankly seen too much pessimism from older generations and cynical power brokers to be silent. The complicit rancor is slowing us down and there is nothing Christian at all about standing in the way of delivering better conditions to our fellow man.

Paradise is lost. In a fallen world we work to do what we can. It isn’t the end of the world. It’s already lost. Now we work because we must. We aren’t building an eschatology to replace the Lord. We build because that is what we are called to do by him.