It’s ok if someone hates me. It’s ok if someone thinks I’m bitchy, stupid, obnoxious and self serving. Hell I’m ok if people think I’m a lesser human being. Which judging by Twitter could be a multitude of reasons ranging from “I’m a woman” to “I’ve got bad taste in tv.”

I am alright with you not being alright with me. My existence is not threatened by your philosophy or personal preferences. My existence is only threatened if you literally threaten me. Call me evil if you like. I’m not offended. Until you take an action against me it’s alright that we disagree. Even if the disagreements are existential.

It’s quite possible this is wrong. I’m open to debate on what constitutes harm. In fact, my entire philosophy centers on that debate being fine. I can take it. I actually pay someone to cuss me out for being stupid and then I pay again to spend time in a group where we regularly tell each other how much the group members anger us. It’s called therapy.

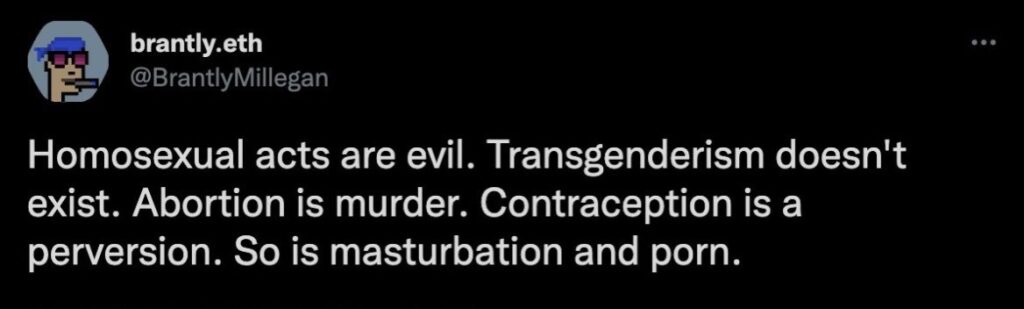

So take that as context when I say I wasn’t particularly personally hurt by Brantly Milligan, aka Brantly.eth aka one of the ENS Foundation cofounders, suggesting women who use contraception are perverts. I’d probably be a lot more hurt if I was a gay trans woman who had an abortion though. But I figure that demo might be used to being called evil by Catholics at this point. Like maybe it’s more of an annoyance than existential threat if you are wealthy and privileged enough to be working in crypto. We aren’t really a population that is hurting

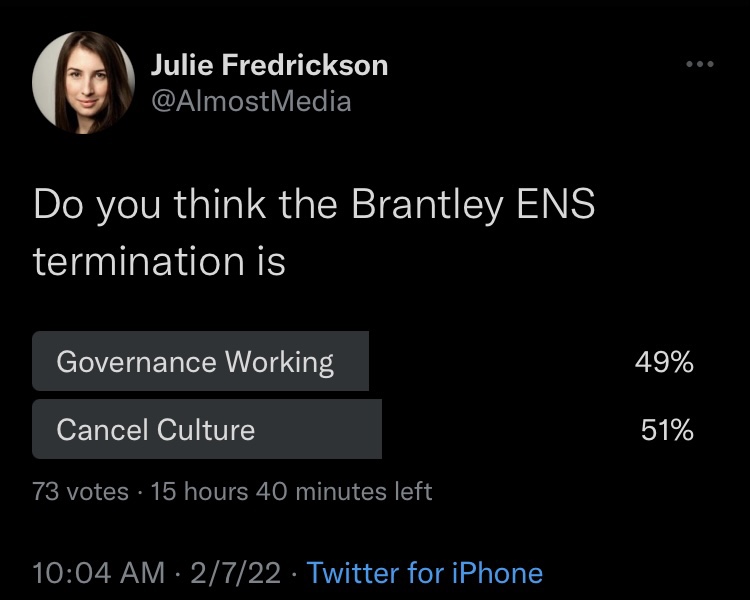

The Ethereum community is experiencing this speech with a lot of pain, hurt and anger. Brantley was voted out of his contract with True Names Limited the foundation that manages ENS Domains. But he remains one of the largest holders of tokens and will obviously have plenty of influence over the future of the platform. The debate has become one of cancel culture versus DAO governance working as intended. But the split on that is not clean and it’s not always clear where people will fall. An informal poll on my timeline is pretty evenly split.

I’m tempted to assign him my tokens as a delegate to be honest. Though I won’t because I think he’s unprofessional. But I want to because I don’t love how any of it played out. Brantly doubled down on telling folks to fuck off compounding the feeling of being hurt. That’s unprofessional and not the kind of behavior I’d expect out of my management team. But I also don’t know that simply holding unpleasant or intolerant beliefs is enough. And it shouldn’t be in a decentralized system. I respect that the right voting and governance may have happened here but I’d argue we all want more control spread out over more people for exactly these scenarios.

I think Brantly basically Shrekli’d himself by doubling down on asshole antisocial shit and the DAO equivalent of the Feds coming for you happened. You can’t attract negative attention and be shocked when bad shit happens to you. But I don’t think being a retrograde weirdo is enough on it’s own to get you booted from an ecosystem.

The entire reason I’m walking you through this sensitive topic today is that I am committing my year to self love. And you might think how does self love and DAO governance overlap. But I really do feel empathy to everyone involved in ENS and the ethereum ecosystem right now. The pain of feeling like you are not seen and loved for who you are is primal shit. This is core human nature “do I belong” to my tribe stuff.

If you don’t love yourself than you are going to have a reactive stance to something that questions your morality and worth. And I’m guessing a lot of people are reactive judging by the uproar. But the thing about self love is that you just won’t be as hurt by assholes being assholes. Because you’ve taken care of yourself first. So whatever the right and just outcome of this ENS governance issue, I think it’s important we all check in on ourselves and why we reacted in the first place. Only then can we get on with the business of design the future and it’s technology.