I am extremely proud of being a subject in Jame’s Pogue’s new Vanity Fair piece. It is about managed decline, the death of state capacity, and whispers of a post state world. I’d say it’s a bombshell except I think there are some very sober people discussing how life in a chaotic world filled with distrust might work out. Spoiler alert, not great.

“Preppers, techies, hippies, and yuppies are converging on the American West, the safest place to “exit” a society gone haywire.”

The Dissident Fringe

I worry that the next frontier in American cultural battles will be figuring out how to stay out of our versions of “the troubles.” And I don’t like the sound of that.

I think you may find yourself agreeing with me. I don’t want a culture war and I certainly don’t want it to turn into a hot war. Apparently that makes anyone who agrees with the above premise a dissident fringe. Didn’t realize it was controversial to enjoy civilization. But I am in fact comfortable saying I don’t want any kind of war.

But I’m not sure everyone feels that way. So in a show of our seriousness we’ve decamped to the imagined demilitarized zone of the Rockies. I don’t want any chaos but I am literally betting the house on us having a bumpy ride maintaining course in America as we deal with long delayed issues from infrastructure, education, logistics and supply chains to capital markets and trade. I intend to capitalize on this uncertainty. You can do so with me if you’d like as an LP in chaotic capital.

If you are curious about how it might play out, in this nearly 9,000 word opus, every angle of how to survive in the American West in the near future is captured in empathetic detail by Pogue. It’s almost like reading William Gibson in how it shows a present that feels a bit off. Cyberpunk right before the Jackpot, but make it from a gonzo Hunter S Thompson type. I appreciate it on purely aesthetic grounds. You should read it.

But practically how do we all muddle through a greyzone war that has no agreed upon values, including whether the enlightenment & liberalism are worthwhile?

As we fight it out as a nation, most of us are just going to continue living our lives as crashing stare capacity and war over institutional norms gets in the way of raising a family and doing business. And it’s this scenario—a muddling, unhappy, middle course—that most people in this sphere tend to predict is coming. It’s not fun but it’s not the end of the world.

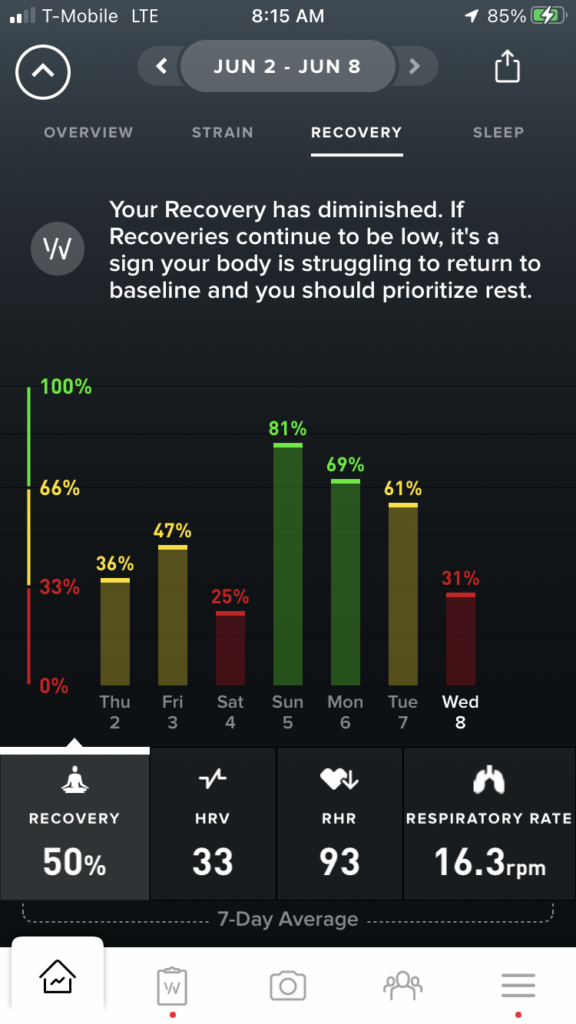

It is my personal belief that we are struggling to find any alignment because regardless of your personal politics, religion, or even overriding philosophy, your actual physical body is just fucking done with this bullshit. I mean it literally. We feel it in our bodies.

Endocrine systems get fried. There’s too much cortisol, you’ve been running on adrenaline, eventually you tap out. Everyone feels nuts right now,” she said, “because what on earth are we supposed to do with the fact that we’ve had this incredible rate of change for so long.”

Julie Fredrickson – Vanity Fair March 2023

We think we’re keeping up with it, but our bodies are like, ‘Oh, actually no. We have no idea what’s going on.’”

It’s too much stress on the system and something is going to have to change.

If you read the piece you will see just how much trust is lost amongst all parties that make up the American experiment. The cherry on top is that our nation state distrusts our foes & but they also distrust us the citizens and their desire for more freedom. It’s a messy battle for meaning and power.

And as Americans we’ve had the exorbitant burden of the dollar being the global currency. What happens when we no longer trust any actors on the global stage? Distrust our fellow citizens, distrust our currencies, distrust our institutions, distrust our enemies? It sure gets hard to run an economy without trust.

We need to build new systems we can trust or our bodies and minds will give out. Simple as.

I don’t know what systems will evolve. But if we don’t start investing in them now we are in serious trouble. I’ve been investing in solutions that are venture scale for sometime. Ifyou want to join me on this journey, DM me on Twitter or join as an LP.