Everyone calm the fuck down and stop panicking while we consider the most dreaded phrase in Silicon Valley: “Balaji was right”.

Sometimes people use a method of persuading you from the extremes. Remember “he means it seriously but not literally?” It works, it nudges the new position into your frame of reference and anything else feels moderate by comparison. But you get to choose what you adopt. You can be optimistic, you can chose new ways of being, you control yourself. But warning: it takes so much energy and effort, which I know because I did a lot of work to adjust my life to tail risks while still believing that you have to live your life.

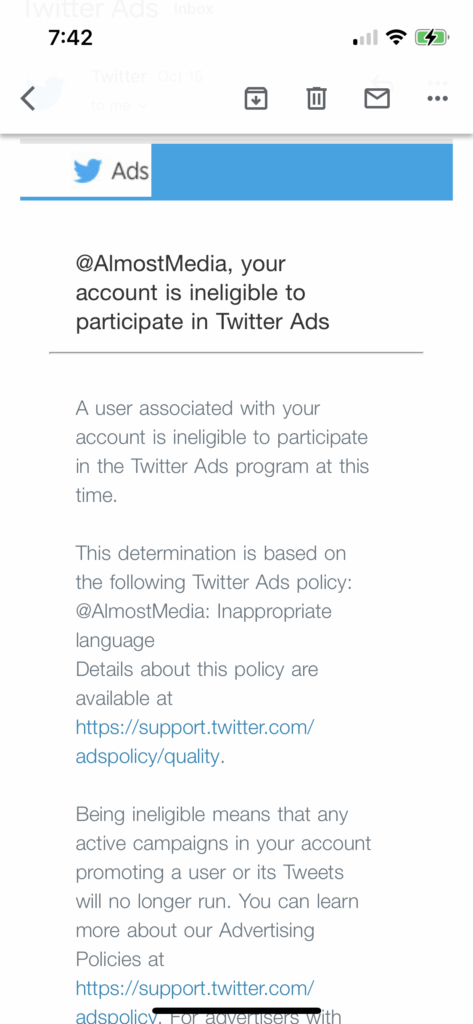

Also, I’m not going to censor anything, so if you’ve got an inclination to cuss me out for not being on your “side”, I’d ask you to remind you that I’m human and winging it just as much as you are. Let’s all remember our humanity.

So are we going into hyperinflation in the next 90 days with Bitcoin going to $1,000,000?

The Next 90 Days

I mean, an apocalyptic scenario is pretty hard to do in ninety days no matter what is happening. Because life finds a way and as my husband Alex likes to say, people revert to the mean. So while I don’t fucking know and neither do you, I don’t think on balance the physics of hyperinflation in 90 days works from where we are now, when talking about the US in particular.

I’m not doing elaborate math though I’ve read the materials. I can make some good guesses based on logical observations of my available data and on human nature. And I think a shock of that magnitude is basically the end of the world. And as much as I think we’ve got to end denialism about how bad shit is for a lot of people, I’m also not sure it’s going to go sideways that fast. Maybe I’m over indexing on having read Gibbon’s “Decline & Fall of the Roman Empire”.

And to the idea that “it’s ok, we’ll all just move to a Bitcoin economy: we’ve got a so much work ahead of us to make crypto and in particular Bitcoin work as a viable alternative for a practical economy it’s not even funny. I think I’m reasonably active in crypto (though probably not as much as you think on a day to day basis). I participate in some DAOs, I have bags with Bitcoin. I believe we can build a better future. But we are small and the problem is big and we need more of you to come in and build it with us if you want an alternative economy that’s actually usable by everyone.

I think this is a good thing because I have had some good experiences with how American capitalism works but I think we can do better. I have some money but I’m not .01%. I like capitalism but I’ve experienced the deep lows of navigating a chronic illness in America before everyone became obsessed with fragility. I’m not saying the systems works.

So while I think a change is ultimately coming (and I’ve made plenty of bets to that effect), I’m not so sure I want the apocalypse to come just to further that end.

After all we can’t build software if it’s the end of the world. Which isn’t a huge leap to make if the dollar hegemony collapses before August. Literally nobody wants that. But a lot of people want more options and it’s our jobs to convince them we can provide it.

So we can use Bitcoin but again, let’s not get ahead of ourselves.

Changing Systems

But I want to be transparent about what I am weighing. I believe we have some negative trends that haven’t been addressed in fractional reserve banking. I believe our world has strained trust about state run capital and currency feels inherently political.

We aren’t that far off the church and state separation, historically speaking. And it took a long time for the separation to hold. But even if time moves faster now, I’d be surprised (though not shocked) if we took down money and state in a quarter. Maybe I’m underestimating dramatically on the exponential. I clearly don’t think it’s impossible because I live in Montana and my revealed preferences tell you something. But I also live near a yuppie city and I make investments in a market economy. I’m torn.

So do I think it takes more time to unwind an empire? Yeah I do.

Do the network affects at play impact monetary policy? You tell me.

We poured a lot of cash into a lot of hands and we have the option of gossiping at scale in public. It feels like no one learned anything from GameStop but I can assure you I did. We don’t totally understand emergent behaviors. Egregores are real and we can summon demons, though we probably shouldn’t and I think it’s a little weird to do so because I’m not confident it won’t kill me.

And there’s a lot of new ground to cover. More deeply tied financial systems, and networks magnified 1000x. Last time around we barely had a functional Twitter and now we have, well ok it’s barely functional now (jk but not).

So we shouldn’t in fact continue to do that by building credibility through showing our work and support and investing in that future?I think so. It’s astonishing it’s as cheap as it is now given how much opportunity it provides. But again we have to keep building it out.

Opening the Window

Finally, one tactical issue I want to address is that Balaji may simply be trying to expand our minds on the possible in front of us and how fast we can do it. I believe the most pejorative way of describing it is manifesting but you can in fact apply energy to making a system move in your favor.

One way you do that is by opening the Overton Window on what is possible and seeing if people step up to the plate to build norms and tools that further your cultural view of the world.

So if you really believe that a change is coming and that people need to prepare for it, yes you push even farther than you might think is actually going to happen. That way, even if someone only comes halfway there, they’ve landed right where you think they need to be.

All this to say: chill out everyone – we’re living in the fastest, craziest times there have ever been and it’s damn easy to get sucked into the vortex. So take a step back, breathe, and make your decisions from a place of calm, not panic.