Discussing travel mishaps has become something of a national pastime for Americans.

Memorial Day Weekend is the official kick off to summer and I had the good fortune of doing a transcontinental flight. And by and large it went smoothly and enjoyably. It was a record breaking day for travel.

I was on a route I’d never done before flying Munich to Houston. I was on my way to my favorite crypto convention Consensus.

Despite the record breaking number of travelers, I had a pleasant United flight. The westward flights can be tricky for sleep as it’s not an overnight.

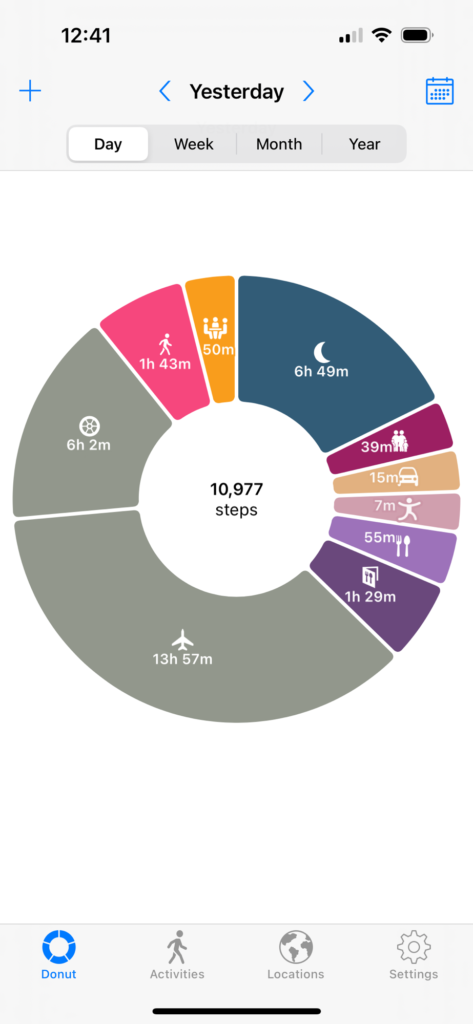

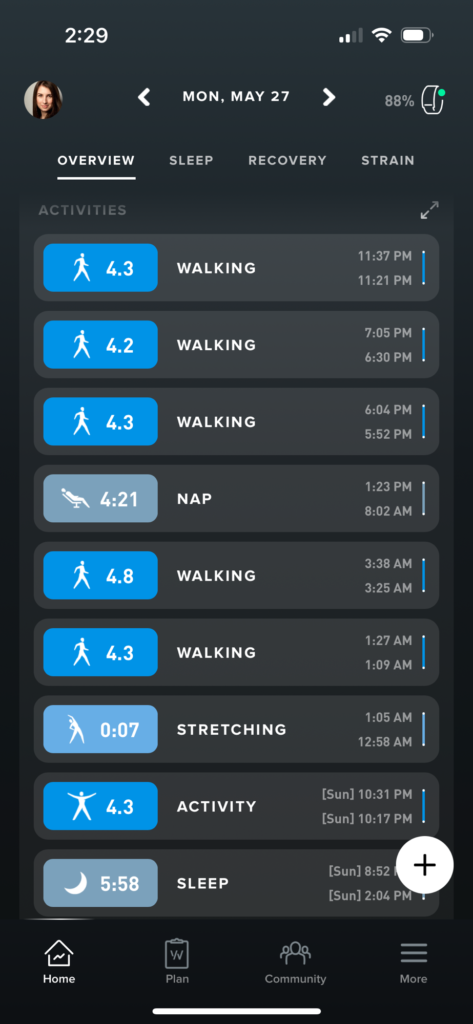

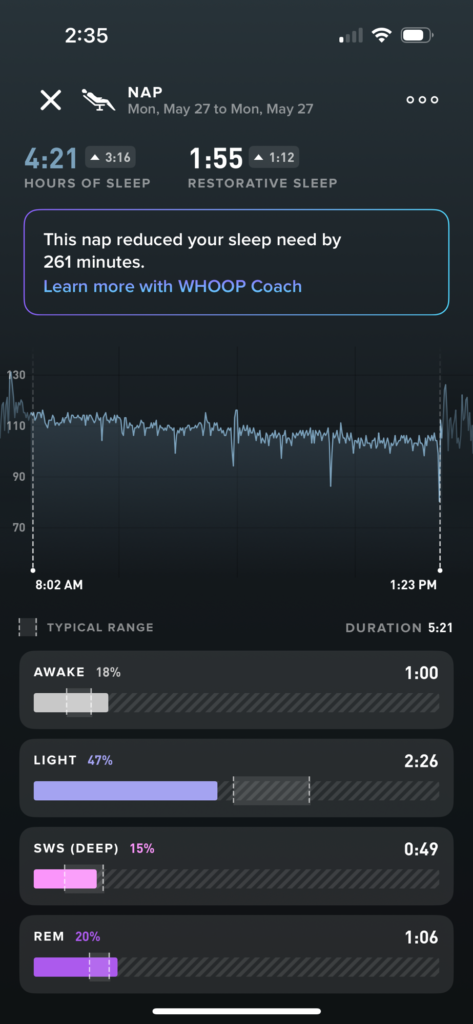

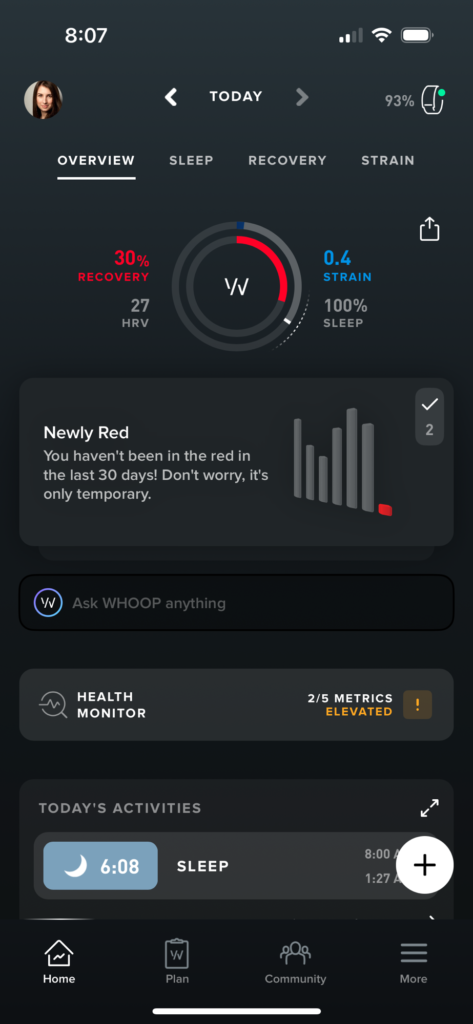

The logistics of this worked out as I slept 6 hours before a 4am wake up for the positioning flight and then on my flat lay got nearly a very decent four plus hours.

My RHR was pretty high from the stress of flying but I was quite impressed that I got restorative sleep and REM. Those flat lays on Polaris really are worth it.

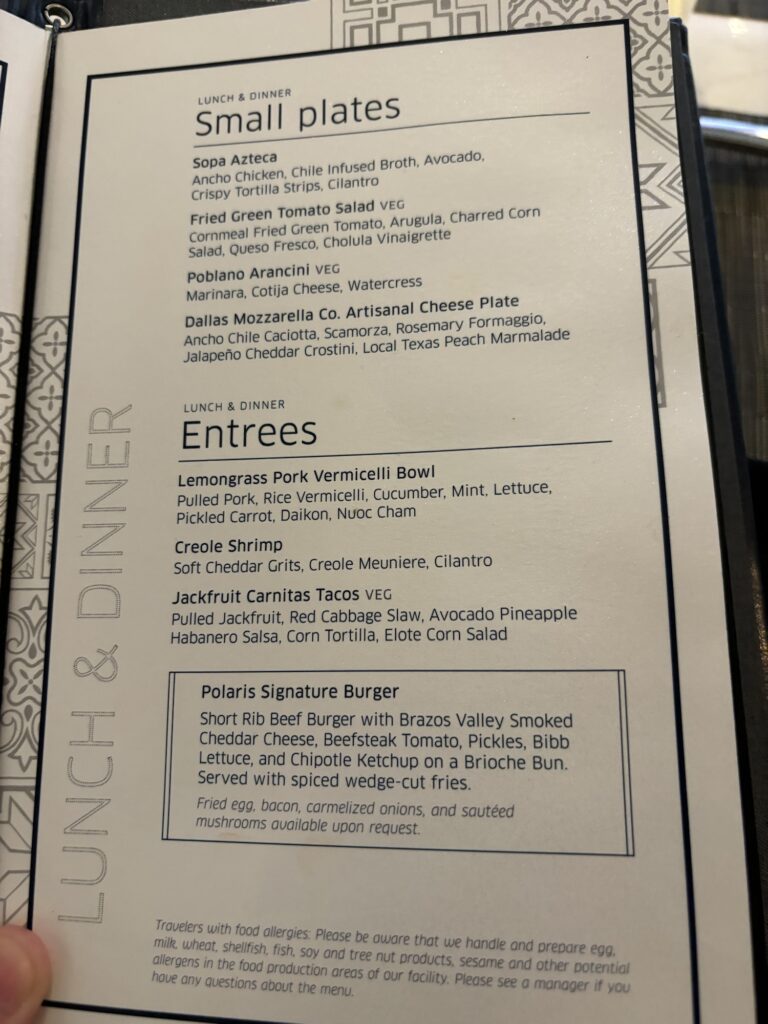

Once I landed in Houston I had a short layover where I was lucky enough to enjoy a sit down meal in the Polaris Lounge. I only wish I’d had more time to enjoy it but clearing customs, going back through security and rechecking luggage takes time.

After all this incredibly pleasant travel there has to be something right? I had a half mile walk to the E gates for my Austin flight. Americans don’t queue well so I arrived at the beginning of boarding. The entire plane boarded only for us to realize we had a serious mechanical issue.

We then deplaned and walked from the end of E gates to the very end of the C gates (about 22 minutes as the New Yorker walks and a mile and a half) to get to the new plane.

The crew was in danger of timing out while catering needed to do a supply for a down line flight. Someone’s executive decision worked in our favor as we got into the air without getting ice for whoever had the airplane next.

What is a two hour drive turned into a five hour ordeal but I made it in one piece and passed out much later than I intended after a full twenty four hours in transit.

If you are in Austin and interested in discussing the intersection of crypto and artificial intelligence I’d love to hear from you. I might need a bit more sleep first though.