I remember the weeks before Covid-19 lockdowns hit vividly. My father went on international cruise, my husband was traveling domestically right up to the last week, and I got yelled at on the internet for discussing buying masks, toilet paper, and disinfectant.

My father got stuck in a Latin American port as borders closed, Alex made it back with mere days to spare before New York locked down and I had a well stocked pantry & dry goods cabinet. I was a prepper long before it became the default of normie Americans after Hurricane Sandy.

So naturally I’m trying to get ahead of the impacts of the tariff war as the last container loads of goods ordered before “Liberation Day” are sold through by American retailers.

Items Most Likely to Experience Shortages if the Drop in Container Cargo from China Persists

If the current sharp decline in container cargo from China to the United States continues, Americans are likely to see shortages-and significant price increases-across several key product categories. This is due to a combination of record-high tariffs (up to 145%) and a dramatic reduction in shipping volumes, with estimates suggesting a 60% to 80% drop in imports from China

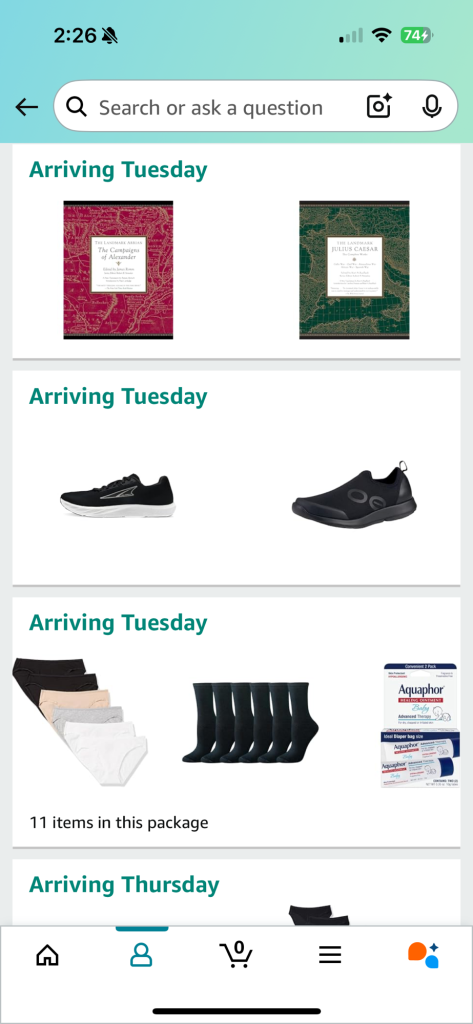

Clothing basics, footwear, and cosmetics are at at the top of the list of potential shortage areas so I stocked up on underwear, socks, Aquaphor and hit “order” on the two pairs of athletic shoes I’ve had languishing my cart for months.

I also decided to treat myself to a few Landmark classics including Julius Caesar and Alexander’s Campaigns. If the empire is falling I may as well revisit some of my schooling.

Plus I just returned from a run through Alexander’s empire so perhaps this is a moment to ground myself on the rise and fall of empires. I never did much care for Rome though but I didn’t expect to be born in a late republic.

I don’t know how this particular supply shock will play out and I feel lucky to be able to spend on thing’s frivolous and essential. Dry feet and military history are as good as any a thing to have on hand. I imagine we will have more serious inventory to do but it’s better to take the first steps.