I wasn’t allowed to watch much media as a kid but some exceptions were made. Frank Capra’s oeuvre was one of those exceptions. Mr Smith Goes to Washington was a classic of civic duty. And now as a Montana citizen it has special meaning to me.

The film is about a naive, newly appointed United States senator who fights against government corruption, and was written by Sidney Buchman, based on Lewis R. Foster‘s unpublished story “The Gentleman from Montana”.[4] It was loosely based on the life of Montana US Senator Burton K. Wheeler, who underwent a similar experience when he was investigating the Warren Harding administration. Via Wikipedia

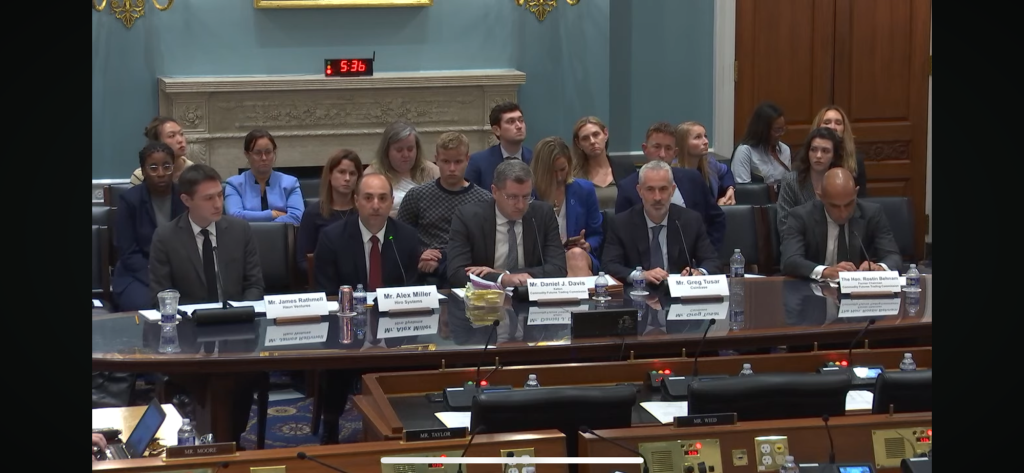

So it was with great enthusiasm today that I cheered on my husband Alex Miller who today was my very own gentleman from Montana. I was glued to CSPAN as I live tweeted his three hour testimony.

Mr Miller served as an expert witness before a Congressional House Financial Services Committee and Agriculture Committee Discussion on “American Innovation and The Future of Digital Assets.” You can watch it all if you’d like.

When he was first invited to testify we weren’t quite sure if it would happen. Behind the scenes there is a lot of wrangling, preparation and negotiations from congressional staffers on both sides of the aisle.

Even then you can still be surprised at the last minute! What was meant to be a bipartisan subcommittee discussing digital assets became most Republicans and maybe officially a roundtable I think? Robert’s Rules nerds will know.

The minority chairwoman walked out with no warning though the rumors circulated late last night that she would protest President Trump’s crypto businesses by walking out. Which is a dick move when many regular developers and businesses are looking for clear regulatory guidance from our legislative bodies.

The poor decorum on the part of Congressional representative Maxine Waters (D-CA) sent the session for a loop as she left at the outset. It would have been more dramatic had it not also come across as a confused elderly woman being pushed around her staffers.

The session quickly moved on to its actual business at hand because as mentioned the future of digital financial innovation is bigger than any one man’s business dealings even if he’s the President.

The future is made by those who show up and departure of some of the Democrats from the hearing did not stop the future from arriving nor the expert panel from testifying. Including the witnesses the minority party called. Yeahhhhh they didn’t get to walk out like Ms Waters.

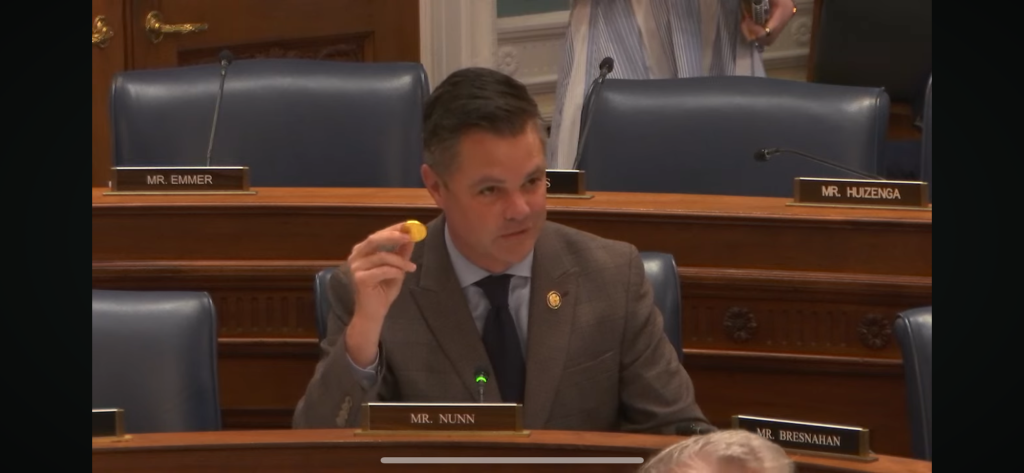

If you have never watched a 3 hour subcommittee hearing I honestly recommend it as an experience. I was very impressed by the questions and expertise brought to bear on the topic. Honestly I even enjoyed the whacky props like a wrapped gold coin from an Easter Basket as an explainer.

It’s easy to make fun of our representatives for grandstanding, politicking, and general chicanery but it’s a serious deliberative body that makes the rules of the road for all Americans.

I got the sense that in this unprecedented moment for the American economy that everyone who stayed took that role very seriously. To which I say thank goodness!

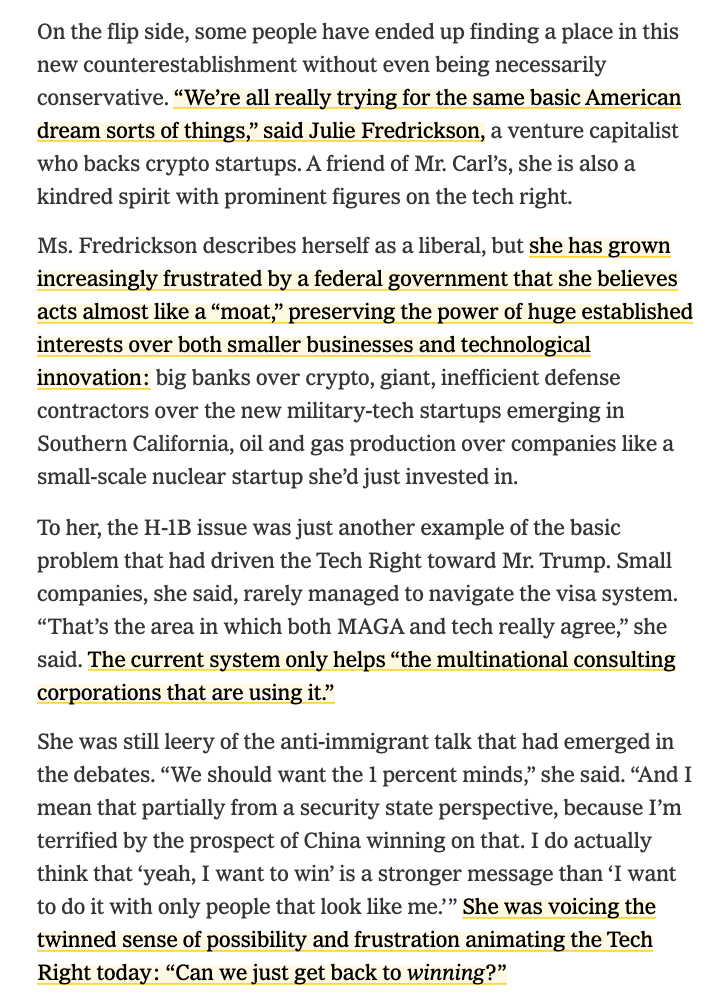

We have no clear rules of the road in digital assets and cryptocurrency and the Securities and Exchange Commission has not helped.

With no regulations passed and the constant threat of investigations and court cases from the Securities and Exchange commission it’s been nigh impossible for American companies to plan and many digital asset firms have moved abroad.

You shouldn’t have to spend thousands of dollars and untold sums of time on $1000 lawyers to be told “we have no clarity”

It’s hurting American businesses as new digital companies move overseas. The Chairman asked “does the lack of clarity hurt consumers, builders and companies?” Every single witness said absolutely.

We need clear rules of the road and regulatory clarity. And we need to be sure as citizens we don’t let our rights be trampled upon in the process. Americans deserve the future of digital innovation being built here and built with our freedom in mind.

There’s a reason that the amendments that protect our core rights use words like “shall not abridge”, “infringe”, or “be violated” in their language as there’s a whole lot that government can do to restrict or functionally take away our rights without “prohibiting” them.

As I myself have worked to successfully passed right to compute work here in Montana I was beaming with pride as Alex fought for that future in Washington today Mr Miller is our gentleman from Montanan. He’s got a little less hair than Jimmy Stewart but he’s fighting for us all.