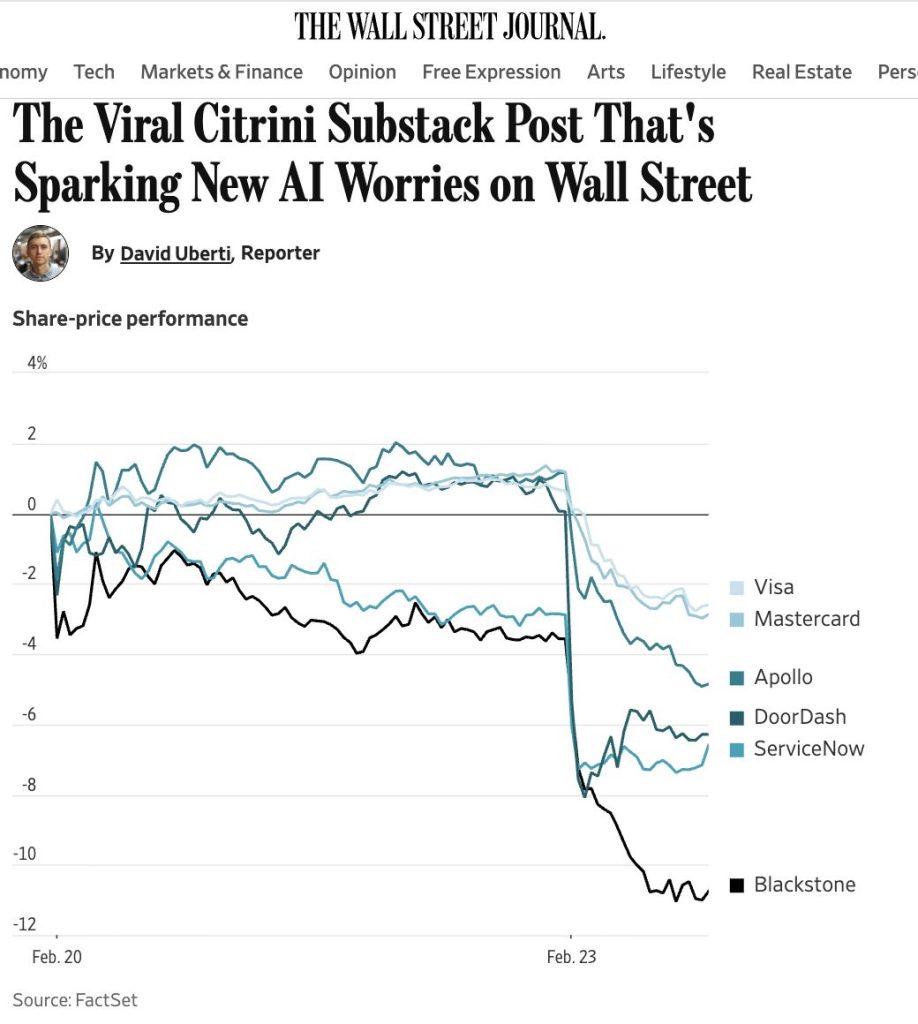

“It’s not a prediction” he said. It’s just a hypothetical possible reality. I believe we used to call that fiction. A science fiction short story wrapped in a macroeconomic essay written by Citrini Research hit the algorithms like a bomb Markets lapped it up like beasts who’d been lost in a barren desert for weeks. Liquidity!

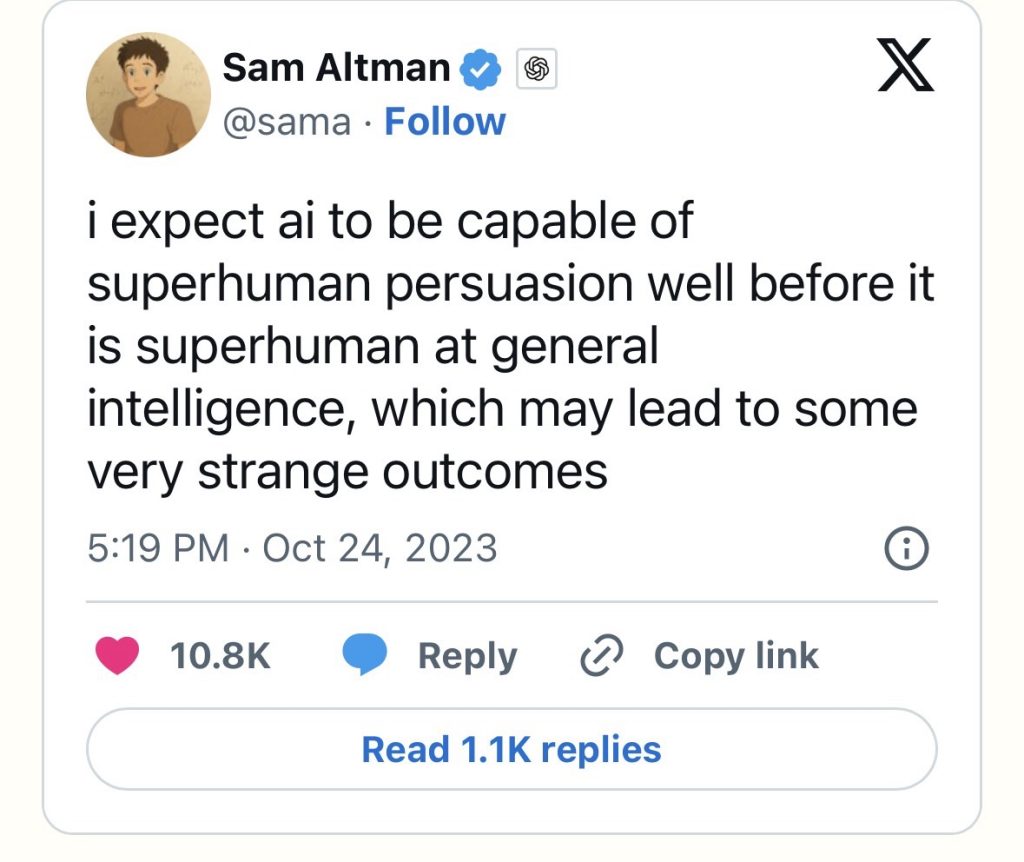

Remember in 2023 when when Sam Altman said that we’d have superhuman persuasion before we had artificial general intelligence?

As the market sell off was playing out, a flood of “Contra Citrini” essays emerged immediately from players as varied as Joe Wiesenthal John Loeber, Will Manidis, even proper economists like Alex Imas. The co-author Alap Shah went onto TBPN. Fun fact he was Sheel Mohnot’s roommate in college.

I am unclear if white collar workers are in a frenzy about are doing their existing jobs or if they have even noticed the danger. As a real time update from a fellow investor had us both laughing. An intern couldn’t manage a basic research task. The intern asked them how to get to the Founders Fund’s website.

We may need the bull case for AI, as the bear case for white collar workers acquiring any intelligence in their education process is rather unconvincing.

For some reason “how do I get to the founders fund website” started me singing an old tune sung by Dionne Warwick “Do you know the way to San Jose?”

Do you know the way to San Jose?

I’ve been away so long

I may go wrong and lose my way

Do you know the way to San Jose?

I’m going back to find some peace of mind in San JoseLA is a great big freeway

Put a hundred down and buy a car

In a week, maybe two, they’ll make you a star

Weeks turn into years, how quick they pass

And all the stars that never were

Are parking cars and pumping gas

The song was used in another completely different “science fiction story goes viral”context. Maybe it’s in my mind as automated virology lab unleashing apocalypse, is a AI doomer staple also recently in the discourse.

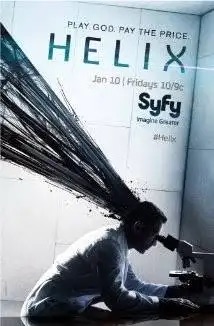

In an SyFy channel show from 2014 called Helix, which follows an Arctic research station where research on viruses goes horribly wrong. It used the Burt Bacharach & Hal David song “Do You Know the Way to San Jose” as an unsettling musical motif and clue to resolving the mystery. Unsettling California music has my ear this week.

In 1968 you could return to San Jose from Los Angeles and start a relatively normal life as one of the stars who never made it. Pumping gas and parking cars. If we get too close to the sun of artificial intelligence success we don’t have a San Jose to run to. You can’t get away there as it’s filled with just the part of technology folks peddling dreams as unrealistic as the ones down in Hollywood.