My husband was joking with me that he’d been arguing, in the way that men do, about what the state is or is not obliged (or allowed) to do about the movement of the capital class and where they keep their resources.

Capital flight and asset diversification are not just individual decisions but increasingly society ones as well. And it’s not just the wealthy who are worried.

This discourse emerged in the middle of the intense upswings in gold & silver prices subsequent profit taking and draw downs.

• Gold ran to roughly 5,600 USD/oz before sliding 7–10% in a day, still leaving it massively higher on the month.

• Silver briefly traded above 120 USD/oz, then fell 15–20% and is now back under the 100–110 area, which technically puts it in a short‑term bear move after a parabolic rise

These actions were stirred up by debate on Federal Reserve independence (ameliorated somewhat by the new chair Kevin Warsh over Kevin Hassett), China’s buying patterns (both official & wealthy retail) in precious metals and what these two interconnected news items might mean geopolitically for regular people. See this on buying in Australia and on China’s flows for more context.

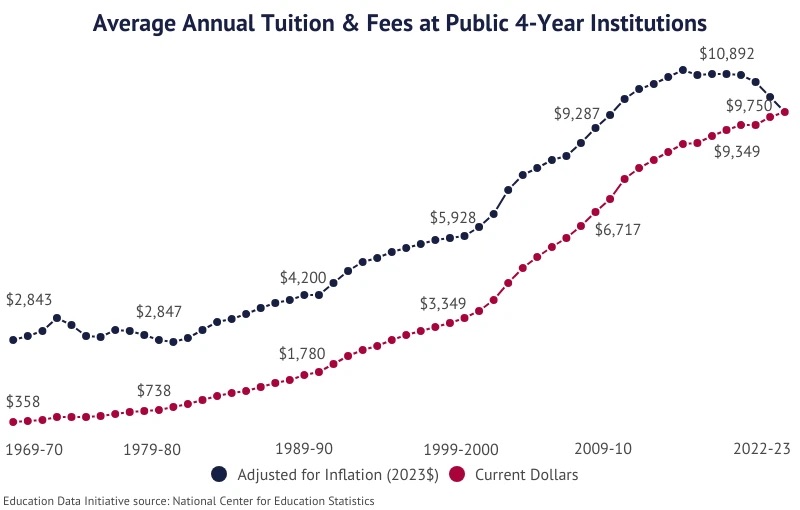

From remittances to capital controls, the debate is particularly spicy as the dollar has been made to trade deliberately lower for the export agenda, rising remittance dollars (and debate on what’s missing in tracking them) has upset many Americans, and the money printing of the Biden years has raised awareness of inflation and national debt.

Obviously it has been a combustible mix. And thus we see renewed interest in decentralized assets and hard commodities. And then, of course, there has been the trial balloon floating in California of a wealth tax. What should we do about our most moneyed citizens and what do they owe. We tax income not wealth and that change is likely to have huge repercussions.

It seems perfectly sensible that anyone who has dollar denominated assets might be concerned about where that currency is headed, who is benefiting from the changes, and what on earth the Chinese are up to both as a people but also as a nation with unclear monetary goals and tensions between its leader and its military.

Ultimately though this is an incident about the dollar, its long term value, who will oversee it (and which Kevin was meant to have the gig) and where wealth can and cannot go to deploy itself in an era where the rules based order and Bretton Woods are no longer a given.