User acquisition is my little niche in the startup world. While all founders are generalists my super power has always been getting the attention of customers. So I often enjoy little illustrative moments where basic principles of finding and speaking to your audience go awry.

I have tweeted extensively about my concern in the rising cost of core agriculture commodities in the face of shitstorm in the fertilizer markets. This isn’t that novel if you work in finance but it’s probably not a large group of people that are actively discussing fertilizer costs. I do not however buy fertilizer personally. I don’t finance it.

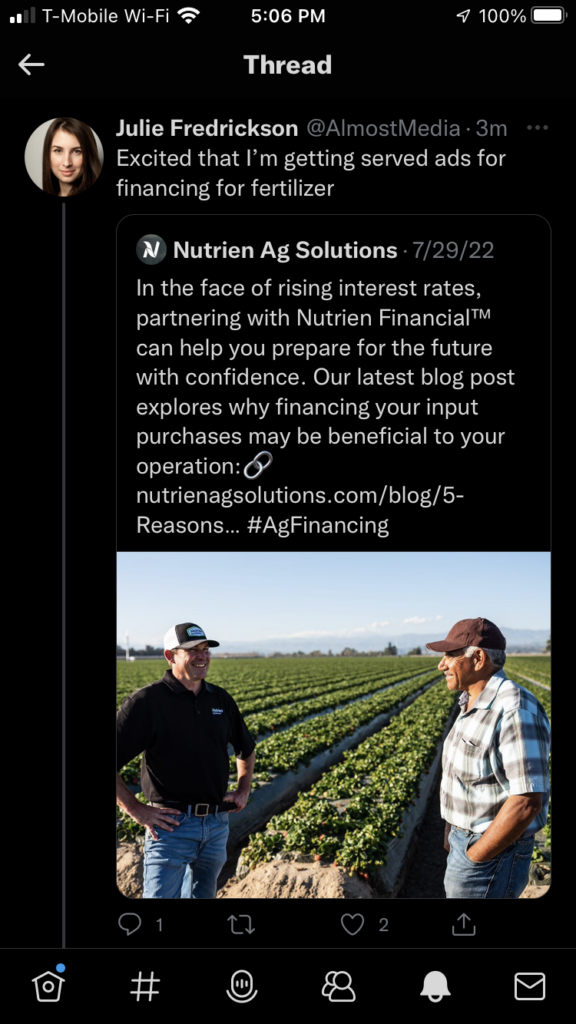

I was served a tweet for Nutrien Financial. They would like me to consider financing my crop inputs. In fairness to this promoted tweet the final demographic detail Twitter may know about me is that I live on rural land with agricultural use zoning. I see how I got targeted. And I am delighted to be served this piece of thought leadership from them. But I’m not in anyway their customers base even though I mimic a lot that matches them.

Let’s compare this to another group of advertisements that targeted me this week. I got several pieces of direct mail in my physical USPS post. These folks knew that I had recently purchased a forwarding service from the USPS to make sure old post from my former Colorado address would reach my new one in Montana. Let’s take a look at what they advertised to me based on that piece of information.

It looks likes advertisers who want to reach married couples that have recently forwarded their mail to a new address might be in the market for furniture, window treatments and also I guess rural road paving services. That one might be a rural Montana thing so slightly more niche.

Advertisers argue a lot about high intent audiences. That basically means someone who is likely to buy your product or service. Lots of people can fall into the typical demographic of what you sell but judging if if they are likely to be persuaded to make a purchase can save you a lot of money. Don’t sell to someone who isn’t buying.

Sure you can convince someone they want something with aspirations and glamour but you have to be able to be convinced. It’s a lot easier to do that for a lipstick than a couch. Significantly harder to do for rural road paving I imagine (though I’ve never done it so I can’t be sure). The hardest has got to be financial products for large scale industrial agriculture purchases. Finding people with high intent to buy fertilizer seems pretty specific.

Marketers can and do try to gussy up these facts with fancy languages but getting attention and selling to people that want to pay attention are basic. I’m not the tactics aren’t complex and the work can’t get extremely technical but at least we know we are working with human desires. And I think it’s important to think through that when planning a campaign. Don’t want to overspend on convincing someone who isn’t even in the market to be convinced.