I love cotton. In my Waldorf third grade, our year long class project was to plant, grow, harvest, gin, card, spin & dye cotton. Along with a similar wool project, this childhood experience instilled a love of fibers, fabrics & textiles in me.

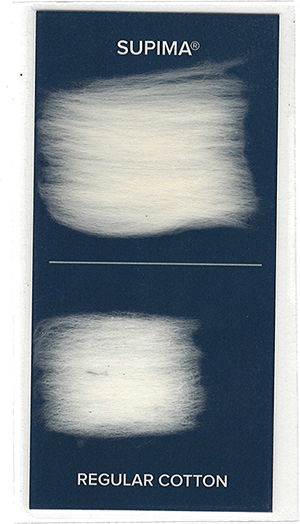

Early in my career I crashed textile trade shows like Premiere Vision which is where I fell for the extra long stable fibers of American grown Pima cotton. Cotton remains a big business in America. We’ve got trademarked cotton like Supima is sold as a luxury fabric.

You’ve probably seen the work of organizations like Cotton Incorporated. Catchy campaigns like “the fabric of our lives” market cotton with the United States Department of Agriculture’s commodity check off program.

The Agriculture Marketing Service of the USDA oversees efforts to improve the position of various commodities produced in America. Other campaigns include Got Milk, Beef: It’s What’s for Dinner, and Pork: The Other White Meat

All commodity producers & farmers must pay into the check off program and it amounts to almost a billion dollars of mandatory spending. As you might imagine this system has had its share of controversy and corruption.

It’s not all sloganeering according to Cotton Incorporated.

We work to make cotton the best it can be through research, textile innovations (like water- and wind-resistant cotton apparel and moisture-wicking, wrinkle- and stain-resistant cotton), and sustainable advancements like finding new uses for cotton and cotton byproducts, reducing land and water usage, and modernizing agricultural processes.

We make sure you know about all of cotton’s amazing benefits through advertising, retail and influencer collaborations.

You might be annoyed to find that American cotton growers are obligated to pay into a government marketing program which underwrites social media influencers.

Cotton is the most popular natural fiber in the world with 25 million tons a year produced so it’s perhaps not unexpected American has an incentive to promote it as one of our commodities.

Cotton is crucial natural fiber which means it has its share of a controversies as commodity for things like its water & pesticide use and genetic engineering to withstand the herbicide glyphosate.

If you’d like to learn more about cotton and its history Empire of Cotton and Cotton: The Fabrice That Made the Modern World are both comprehensive. I personally recommend Virginia Postrel’s The Fabric of Civilization for a broader appreciation on how textiles drove crucial technological innovation of our species.

In The Fabric of Civilization, Virginia Postrel synthesizes groundbreaking research from archaeology, economics, and science to reveal a surprising history. The cloth business spread the alphabet and arithmetic, propelled chemical research, and taught people to think in binary code.

This thesis suggests to me that fashion bitches are one of the original tribes of technology brothers. To care this much about the feature sets of a base layer clearly marks us as nerds. So I’ll finish this up with a personal anecdote.

I am furious at a brand of upper market cotton basics called Splendid. I’ve been buying the same long sleeve classic tee-shirt from them for at least a decade. It claims to be a 50% blend of Pima cotton and Modal. Both are considered premium fabrics with long fibers. Modal is a semi-synthetic developed in Japan made from beech trees. There are many grades of both fibers Splendid could source and in the past I’ve found the tee to wear extremely well. I’ve got a half dozen that never pilled, held its color & shape, and gave me years of wear.

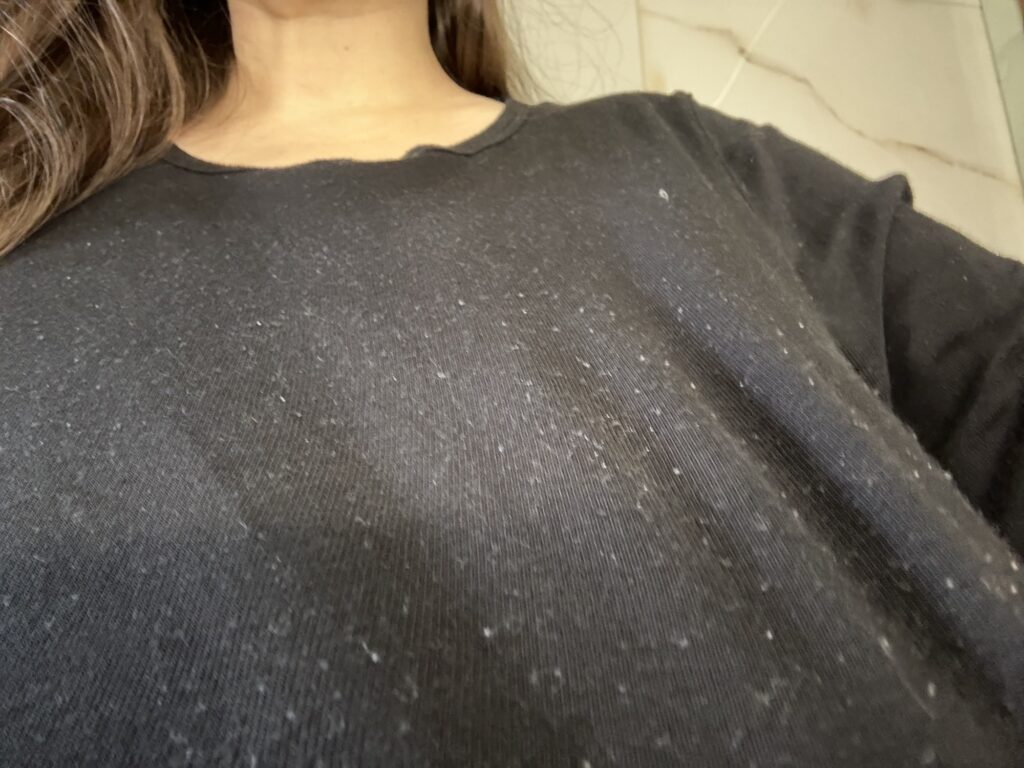

Last month I bought three new Splendid tees as I becoming fearful of the downward trend in quality of manufactured goods. I’ve been trying to stock up on basics I’ve relied on in the past. Alas it would seem my most reliable shirt in my favorite fabrics has come to an ignoble end.