A bad workman blames his tools

Idiom

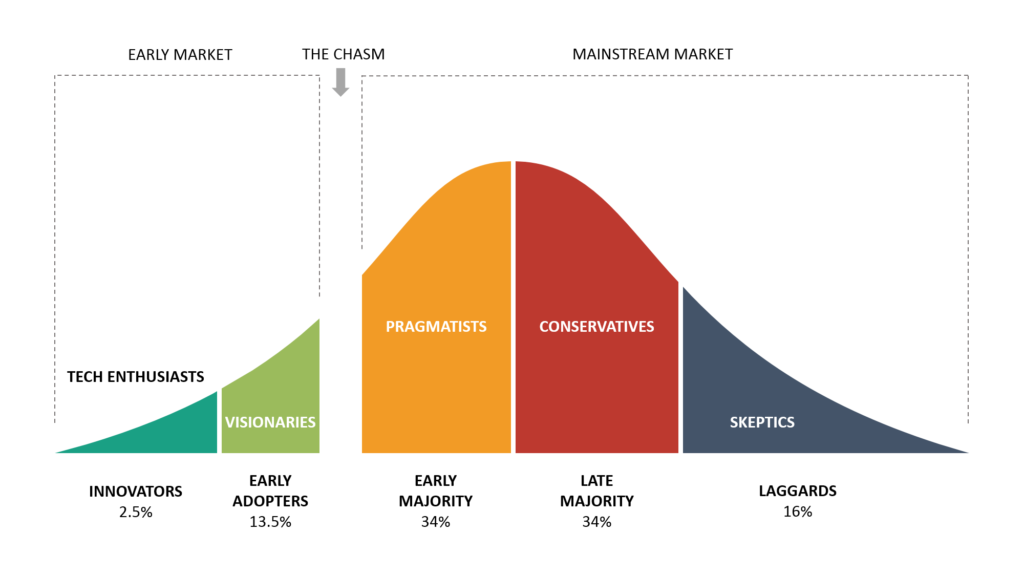

As we rapidly accelerate the power of our computing tools, machine learning has blossomed into the most heated topic in government policy, business strategy, and popular culture, as artificial intelligence begins to affect everyday life.

The focus on harms, and in particular singularity doomerism, has (ironically) pulled focus from the implications of the seminal “attention is all you need” paper.

Astonishing as it may seem at times, intelligence does not top out at “median human”, but can, and possibly will, go much further.

What a triumph this represents. We will all have access to tools that will enable our entire species to build. More intelligence applied to more problems means more solutions to very real human problems.

I am in Austin Texas for Consensus 2024. I’ll be participating a town hall to discuss how crypto’s mindset of open-source, decentralized computation might help us grapple with who builds, maintains, & owns AI tools.

Policymakers and Silicon Valley executives are both calling for regulation of artificial intelligence as fears grow over its potential harms. But others warn of entrenching a dominant, opaque, centralized Big Tech model and instead advocate for open-source code, decentralized computation and distributed data sourcing. Whom should policymakers listen to? What, if anything, can governments do to help this vital technology evolve in a pro-human way?

Thankfully, we aren’t starting from scratch in building a regulatory framework for artificial intelligence. Code has been treated as speech in Bernstein v. United States Department of State. It would seem like a reasonable precedent to consider algorithms speech as well.

And let us be clear, math and computing power are as essential as speech. In today’s world, they ARE speech. Humans may speak in natural language, but the way we extend ourselves, build things, and grow as a species is through our tools. Computation is a tool. To presume that these tools do harm is to make us bad workmen.

Now of course incumbent powers may try to keep the disruptive and democratizing power of these tools out of the hands of the populace “for their own safety”, but imagine if the first amendment had been frozen in time at the printing press and didn’t protect the internet? We cannot accept permanently lowered standards of fundamental rights.

The 90s era fight for strong encryption enabled a flourishing of digital businesses from finance to e-commerce. We must insist that the freedom to innovate remains the default for U.S. digital policy.

Ultimately, I agree with R Street’s Adam Thierer. He says “fear based narratives that prompt calls for preemptive regulation of computational processes and treat AI innovations ‘as guilty until proven innocent’ are no way to make good policy.”

America does not have a Federal Computer Commission for computing or the internet but instead relies on the wide variety of laws, regulations, and agencies that existed long before digital technologies came along.

R Street Comments on NTIA

If we are to regulate sensibly, let us treat artificial intelligence as we would any other tool and let us do so within the existing framework of our constitutional rights and their interpretations within past precedents.