I spent most of yesterday on an airplane. I flew nearly 12 hours along the polar routes to go from Heathrow to America’s west coast. I flew British Airways and was disinclined to spend the many pounds for internet access.

Alas this meant I missed the rollout of the joyful flight of one of my favorite investments. Valar Atomics began its journey from California to Utah just as I too was flying. Me and the reactor I angel invested in were both up in the air like bluebirds and sunshine.

HILL AIR FORCE BASE, Utah, Feb 15 – The U.S. Departments of Energy and Defense on Sunday for the first time transported a small nuclear reactor on a cargo plane from California to Utah to demonstrate the potential to quickly deploy nuclear power for military and civilian use.

The agencies partnered with California-based Valar Atomics to fly one of the company’s Ward microreactors on a C-17 aircraft — without nuclear fuel — to Hill Air Force Base in Utah. Via Reuters

I tear up just thinking of the incredible accomplishments of millions of people coordinating together across centuries that these technologies represent.

It’s easy to think of ourselves as being small in the vastness of time and space. I almost cannot believe I was handed such gifts in this life, but I can claim a small but early part in Valar’s story.

Just a little over three years ago I sent Isaiah a message on Twitter. We had a lot in common and I felt a kinship with this young entrepreneur. It was before he had even begun the incorporation work on Valar. He was working on something else, but I trusted his quiet intelligence and admired his humble inquisitiveness. We kept in touch as he mapped out his path.

His lack of ego instantly marked him as special, as it meant he could hear even the hardest criticisms. His fortitude was clear. He could incorporate what was necessary into his mission, a skill usually developed much later in life.

It’s rare to build trust so early on, and yet we both did. I told him I’d back anything he did so long as he was the CEO. Little did I know just how lucky I would end up as his very first backer.

You might think you will have doubts in high risk early stage investing. But I’d be lying if I said I didn’t believe in him from day one. I knew he was on a mission bigger than any of us. I knew it and he knew it. For God and country as they say.

That faith was required, as it was tested in rapid succession again and again over the next three years. Chewing glass is part of every startup. Even when you go as rapidly as Valar has gone, there are harsh conditions, brushes with death, and moments of utter joy in between.

Not only did we write a first check in the angel round, but in tight spots before the seed closed we wired follow on within minutes when a concern about a cash flow question arose. We put together special purpose vehicles. Nothing could jeopardize this mission. I’d invest more if I could.

We weren’t always the ideal investors as we struggled to showcase to bigger and better firms our conviction. Not too long ago it was all about being asset light and software as a service. Thankfully the execution always outshone the skeptics and we were ahead of the times. And while the skepticism was fierce, Isaiah never wavered. Neither did I.

Today is day 1873 in my daily writing log. I first wrote about Isaiah on Day 1145 which means somewhere around day 780 or so is likely when we first met. I wrote on day 1510 almost a year ago about their seed round and the first successful thermal testing. On day 1721 they broke ground in Utah.

And you can better believe that I am looking forward to July 4th this year. We promised the president we’d be turning on the reactor, so there is much to be done between now and then.

At March Air Reserve Base, California, yesterday, a next-generation nuclear reactor was loaded aboard a C-17 Globemaster III aircraft for transport to Hill Air Force Base, Utah. The reactor will eventually head to the Utah San Rafael Energy Lab for testing and evaluation.

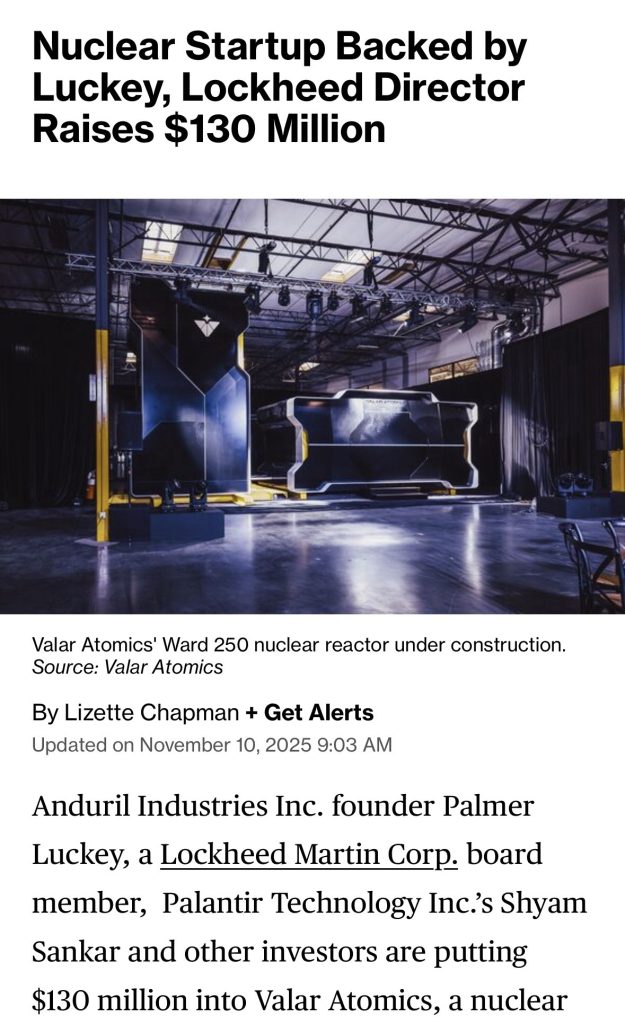

The Ward 250 is a 5 megawatt nuclear reactor that fits into the back of a C-17 aircraft could theoretically power about 5,000 homes.

For military use, such a reactor could provide energy security on a military base ensuring the mission there need not depend on the civilian power grid, and in military operations overseas, such reactors would mean U.S. forces could operate without concern that an enemy might cut fuel supplies.

A reactor such as the Ward 250 also means greater energy security for the entire United States. It is firmly in line with President Donald J. Trump’s executive orders to reshape and modernize America’s nuclear energy landscape.

The president signed four executive orders designed to advance America’s nuclear energy posture, May 23, 2025. Those include “

Reinvigorating the Nuclear Industrial Base,

” “

Reforming Nuclear Reactor Testing at the Department of Energy

,” “

Ordering the Reform of the Nuclear Regulatory Commission

,” and “

Deploying Advanced Nuclear Reactor Technologies for National Security

.”

Michael P. Duffey, the undersecretary of war for acquisition and sustainment, said the partnership between the War and Energy Departments is critical to advancing the president’s nuclear energy initiatives.

“It’s clear to me that advancing President Trump’s priority on nuclear energy depends on close coordination between the Department of Energy and the Department of War,” Duffey said. “This partnership ensures advanced nuclear technologies are developed, evaluated and deployed in ways that strengthen energy resilience and national security.”

The future of warfare is energy-intensive, he said, and includes AI data centers, directed-energy weapons, and space and cyber infrastructure. The civilian power grid was not built for that, and so the War Department will need to build its own energy infrastructure.

“Powering next generation warfare will require us to move faster than our adversaries, to build a system that doesn’t just equip our warfighters to fight, but equips them to win at extraordinary speed,” Duffey said. “Today is a monumental step toward building that system. By supporting the industrial base and its capacity to innovate, we accelerate the delivery of resilient power to where it’s needed.”

Secretary of Energy Chris Wright said that with small reactors like those transferred from March Air Reserve Base to Hill Air Force Base, the United States is aiming for a nuclear energy renaissance.

“The American nuclear renaissance is to get that ball moving again, fast, carefully, but with private capital, American innovation and determination,” Wright said. “President Trump signed multiple executive orders that have unleashed tremendous reform of all the things that stopped the American nuclear industry from moving.”

Part of that effort, he said, will mean that by July 4, three small reactors will be critical — or running smoothly.

“That’s speed, that’s innovation, that’s the start of a nuclear renaissance,” Wright said. By

, Pentagon News